Roth IRAs are attractive savings vehicles. After tax money placed into a Roth IRA grows tax-free and then can be taken out tax-free. It would be a tremendous benefit for a Roth IRA owner to put as much money as possible into the product. Unfortunately, this is not possible because a Roth IRA is considered qualified and is restricted as to the amount of contribution and who qualifies to contribute. The good news is that these tax benefits are available elsewhere in the form of cash value life insurance.

The Savings Benefits of Cash Value Life Insurance

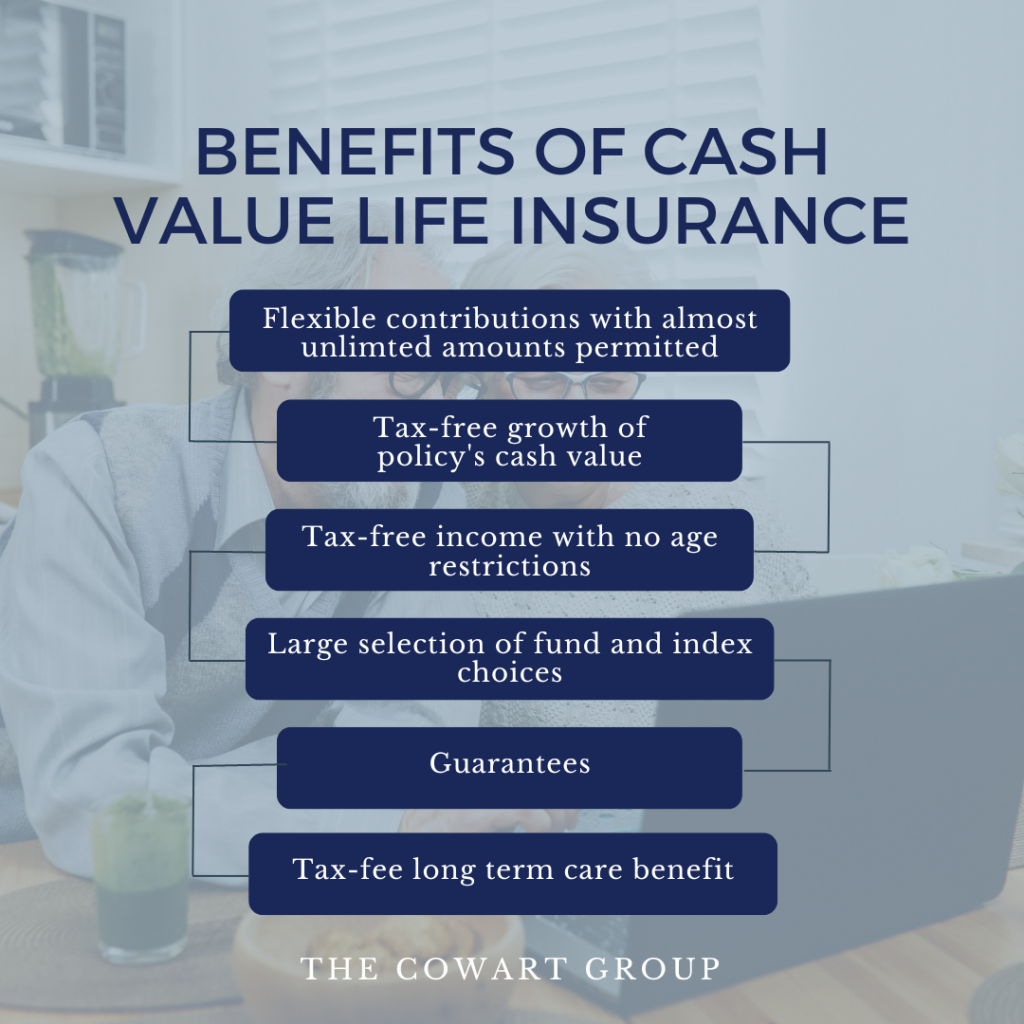

When saving for the future, no other vehicle provides the tax-advantages of cash value life insurance. Policyholders can expect these benefits:

- Flexible contributions with almost unlimited amounts permitted

- Tax-free growth of the policy’s cash value

- Tax-free income with no age restrictions

- Large selection of fund and index choices for investment underlying the policy

- Guarantees

- Tax-free long term care benefit

- Cash value that is wholly exempt from creditors[1]

For those seeking to save more for the future – whether for retirement, educational expenses, a first or second home, unexpected health-related expenses – The Cowart Group can help identify and evaluate all the options available.

Not Your Parents Life Insurance

Not Your Parents Life Insurance

When most people think of cash value life insurance, products like whole life or universal life come to mind. These are considered ‘retail policies’ and while they offer some of the benefits described and are perfectly adequate as savings vehicles, they are no longer the best option available. When it comes to utilizing life insurance for nonqualified savings, The Cowart Group is able to offer institutionally priced policies that were once only available to the largest corporations. Known as corporate-owned life insurance (“COLI”), these policies offer high, early cash values, lower policy charges, and a broader array of underlying fixed and variable investment options.

Instead of paying into a retail policy and seeing a very low asset value because of the surrender charge, COLI policies eliminate this charge and have an immediate, high asset value. In addition, COLI policies lower insurance costs due to data collected that shows those who purchase COLI tend to live longer. What all these savings mean for the policyholder is that there is more of their premiums that are put to work to grow tax-free for the future.

The benefit experts at The Cowart Group can show how a COLI policy can enhance future savings. Whether it is a single individual or a company with hundreds of interested participants, there is an institutionally priced COLI choice available.

About that Yield

“I know life insurance usually has pretty stable returns but aren’t the yields low?” For decades, this has been a concern when consumers were presented with general account retail products like whole life and universal life where the insurer largely determine the rate of return to the policyholder. Now, with variable and index options, policyholders can take control of how their premiums are invested and can choose to incorporate guarantees that prevent a loss of principal.

Instead of standard, general account product returns between 3% and 5%, COLI policyholders can choose from a multitude of index options that have ceilings of 10% or more and guaranteed floors of zero percent. In today’s volatile market, having upside potential with downside protection in a nonqualified savings vehicle is appealing. If a variable COLI product is chosen, many of the investment options have no limits for growth and any negative performance can often be mitigated by available guarantees.

The flexibility of a COLI policy opens up so many avenues for putting money to work in a tax-free environment. The Cowart Group’s product experts can determine a suitable solution to meet established financial goals and objectives.

Savings You Do Not Have to Use

Those who die holding qualified retirement accounts, securities, annuities and most other financial products face harsh income taxation. That tax bill could be immediate to the estate or down the road to the beneficiaries. A dollar left could turn into twenty-five cents by the time the IRS is done. Not so with cash value life insurance.

When a policyholder dies, all the savings within the policy plus an additional death benefit is paid to beneficiaries income tax-free. If the policy is held in an irrevocable trust, the proceeds would also be estate-tax free. In effect, those choosing cash value life insurance to save can see their savings grow tax-free, access the savings tax-free by way of policy withdrawals and loans and then pass whatever funds are left at their death plus an extra sum from the death benefit tax-free to heirs.

How a cash value life insurance policy is structured is key to obtaining the best results. The Cowart Group can model potential outcomes for one participant or, where a company is interested in bolstering income benefits, for hundreds.

Get Started

Low-expense policies offering a choice of investment option and available with riders that include the ability to make tax-free distributions to meet long term care needs are no longer only available to large corporations. Through The Cowart Group, those who are interested in tax-efficiently growing money to meet future income goals can explore if a COLI policy is a fit.

The financial professionals with the Cowart Group provide tailored financial solutions to families and businesses that count on our experience and dedication to their success. Our aim to deliver quality advice derives from our relationships with insurers, our underwriting advocacy, and technology resources. We provide strategies and solutions designed to assist our clients in benefiting from and optimizing existing and changing government regulations.

[1] Policy beneficiary must be a spouse, child or other family member as beneficiary (AL, AZ, HI, ID, IL, IN, MD, NC, OH, OK, PA, SC, TN, VA);